Table of Contents

ToggleAmerican Brands in Asia that are trying or are dominating Asia Market.

With the tariffs hitting, what are Asians thinking about these brands?

Asia has become a critical battleground for American multinational corporations (MNCs) across industries. From fast-moving consumer goods (FMCG) to automotive, IT, telecommunications, retail, and fashion, U.S. brands have aggressively expanded into the region, adapting to local tastes while leveraging their global appeal.

This comprehensive guide explores:

✔ Leading U.S. brands in each sector

✔ Their market penetration strategies

✔ Localization efforts for Asian consumers

✔ Key challenges they face

✔ Future growth prospects

1. Fast-Moving Consumer Goods (FMCG)

Coca-Cola & Pepsi – Beverage Dominance

- Coca-Cola operates in every Asian market, with China and India as top growth regions.

- PepsiCo competes strongly, especially in snacks (Lays, Kurkure in India).

- Localization: Green Tea Coke (Japan), Maaza (India), Aquafina (Pepsi’s water brand).

Procter & Gamble (P&G) – Household & Personal Care

- Brands like Pantene, Gillette, Olay, and Pampers dominate in:

- China (Olay is a premium skincare leader)

- India (Whisper sanitary pads, Vicks)

- Southeast Asia (Head & Shoulders is a top shampoo brand)

Unilever (U.S.-UK but major American influence)

- Dove, Lux, Lipton, Magnum, and Ben & Jerry’s are household names.

- India (Hindustan Unilever) is one of its biggest markets.

Why they succeed:

✔ Hyper-localized products (e.g., Fair & Lovely in South Asia)

✔ Strong distribution networks (even in rural areas)

✔ Acquisitions of local brands (e.g., Horlicks in India)

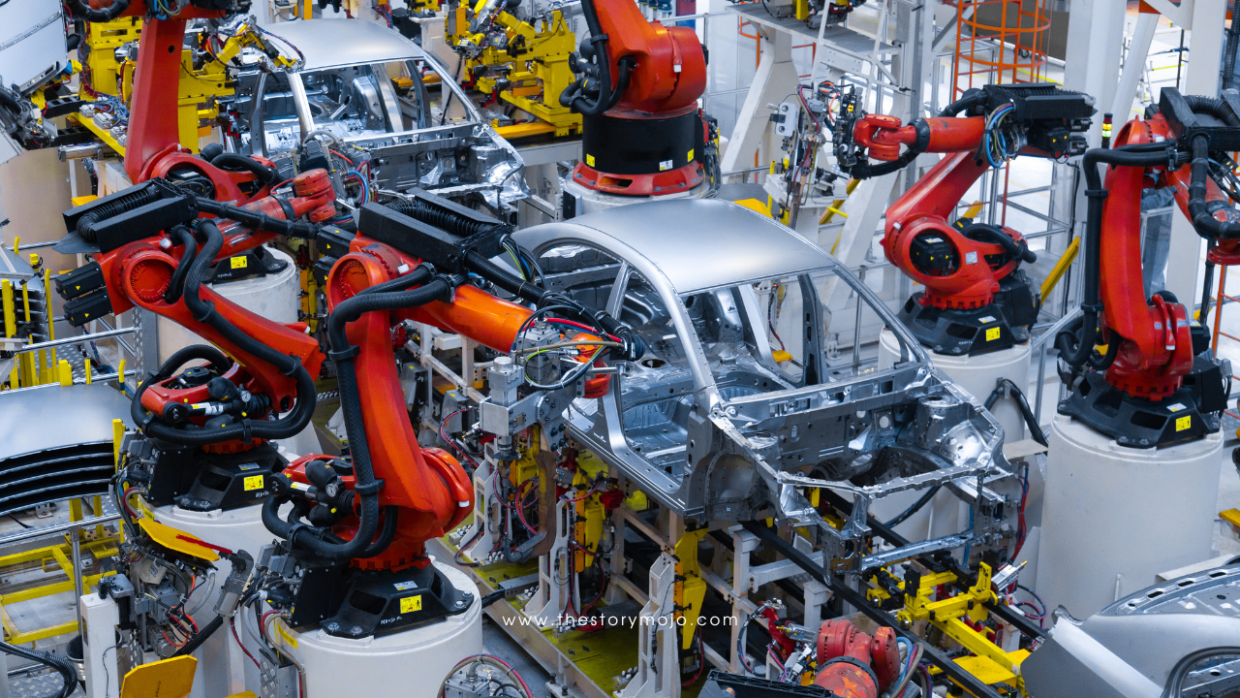

2. Automotive – Electric & Traditional Vehicles

General Motors (GM)

- China (via SAIC-GM joint venture) – Buick and Cadillac are luxury favorites.

- India (Exited in 2017 but Chevrolet remains) – Struggled against Maruti & Hyundai.

Ford

- Focus on commercial vehicles in India & ASEAN (Ford Ranger in Thailand).

- China struggles due to stiff local competition (Geely, BYD).

Tesla – The EV Disruptor

- China (Gigafactory Shanghai) – Produces Model 3/Y for local & export markets.

- Japan & South Korea – Premium EV demand rising.

- India (Upcoming factory) – Plans for affordable EV models.

Challenges:

✔ High import taxes (India’s 100% duty on foreign EVs).

✔ Local rivals (BYD in China, Tata in India, Hyundai in Korea).

3. Information Technology (IT) & Consumer Electronics

Apple – The Premium Tech Leader

- China (20% of global revenue) – Despite Huawei’s resurgence.

- India (Fastest-growing market) – Manufacturing iPhones locally to cut costs.

- Japan & South Korea – Strong brand loyalty despite Samsung & Sony.

Microsoft – Enterprise & Cloud Dominance

- Azure & Office 365 are widely used in Japan, India, and Singapore.

- LinkedIn is the top professional network in India & Southeast Asia.

Intel & AMD – Semiconductor Giants

- Major suppliers for Chinese & Taiwanese tech firms (Lenovo, ASUS).

- Facing competition from local chipmakers (SMIC in China).

Google & Meta (Facebook, Instagram, WhatsApp)

- India (Biggest user base outside U.S.) – WhatsApp has 500M+ users.

- Indonesia & Philippines – Facebook & Instagram dominate social media.

- China (Banned) – Replaced by Baidu, WeChat, Weibo.

4. Telecommunications (Telco) – Infrastructure & Services

Cisco – Networking & Cybersecurity

- Major supplier for 5G infrastructure in Japan & South Korea.

- India (Growing demand for enterprise solutions).

Qualcomm – Chipset Supplier for Asian Smartphones

- Dominates Android processor market (Xiaomi, Oppo, Vivo use Snapdragon).

- Facing antitrust issues in China & South Korea.

AT&T & Verizon (B2B Services in Asia)

- Provide cloud & enterprise solutions but no direct consumer presence.

5. Retail – E-Commerce & Hypermarkets

Amazon – Mixed Success

- Japan (Strong presence) – Fast delivery, Prime Video.

- India (Competes with Flipkart & Reliance) – Invested $6.5B+.

- Southeast Asia (Lost to Shopee & Lazada) – Exited some markets.

Walmart (Via Flipkart in India)

- Owns 77% of Flipkart – Competing with Reliance’s JioMart.

- Wholesale stores in China (Sam’s Club).

Costco – Premium Bulk Retail

- China (Huge success in Shanghai) – Long queues at opening.

- South Korea & Japan – Expanding rapidly.

6. Fashion & Luxury – Apparel & Accessories

Nike & Adidas (U.S.-German but major U.S. influence)

- China (Nike’s second-largest market) – Facing backlash over Xinjiang cotton.

- India (Rising sportswear demand) – Competing with local brands.

Levi’s – Denim Culture in Asia

- Japan & South Korea – High demand for premium denim.

- India (Growing middle-class appeal).

Michael Kors, Coach, Tommy Hilfiger

- Popular in China, Japan, and South Korea as affordable luxury.

- India (Expanding in metro cities).

7. Food & Beverage (Beyond FMCG)

McDonald’s, KFC, Starbucks (See Previous Section)

Domino’s Pizza (Master franchise model in Asia)

- India (Biggest market outside U.S.) – Operated by Jubilant FoodWorks.

- Japan & China – Localized toppings (seafood, spicy paneer).

Subway, Burger King, TGI Fridays

- Struggling against local fast-food chains (Jollibee in Philippines, MOS Burger in Japan).

Key Challenges for U.S. Brands in Asia

✔ Regulatory hurdles (China’s data laws, India’s FDI restrictions).

✔ Local competition (Alibaba vs. Amazon, BYD vs. Tesla).

✔ Cultural adaptation (Menu changes, marketing strategies).

✔ Geopolitical tensions (U.S.-China trade wars).

Future Outlook: Which U.S. Brands Will Win Asia?

- Tesla & Ford (EV expansion in India & ASEAN)

- Disney+ & Netflix (Streaming wars vs. local platforms)

- Chipotle & Shake Shack (Premium fast-food growth in China)

Conclusion: Asia Remains a High-Growth Market for U.S. Brands

American companies that localize effectively, invest in supply chains, and navigate regulations thrive in Asia. While Coca-Cola, Apple, and Nike dominate, others like Tesla and Amazon face tougher battles.

Which U.S. brand do you think will conquer Asia next? Let us know in the comments!

©2025 thestorymojo.com All rights reserved.

Be the first to leave a comment